The distribution market is a growing market, with more and more participants, of different sizes. How can we explain the growing number of distributors ? Who are the main distributors in this market ?

More and more distributors on the market

In 2020, the CNC counted 971 active film distributors in France, up from 276 in 2007 and 181 in 1998. Over time, the number of films produced has increased, as well as the number of copies, the number of movie theaters and the number of films shown in each movie theater, which is why the distribution sector has grown and expanded.

The early 2000 : the distribution boom

In the early 2000s, the number of films produced each year exploded. Producers were looking for a distributor who could promote and offer a large distribution of their films. To meet this growing demand, many distribution companies were created or split up : it is estimated that an average of 10 new companies were created each year at that time.

These increasing numbers of distributors allow films to be shown on a greater number of screens. In 1998, a film was shown on an average of 547 screens compared to 708 screens in 2007. For American films, the average was 903 screens in 2007. The Americans are indeed far ahead of France in terms of number of copies and distribution of films. The Americans produced on average more than 70% of the animation, adventure and fantasy films produced in the world at that time. These genres are also the ones that are the most diffused in movie theaters.

The growth of the film distribution market allowed it to become a very profitable sector in the 2000s, since the vast majority of these companies release between 1 and 10 new films per year, each of which earns them an average of €685,830, according to the CNC. Thus, French distributors have collected between €350 million and €450 million each year. This is largely due to a number of successful films such as Titanic or Asterix and Obelix Mission Cleopatra, which bring in hundreds of thousands of euros.

Since 202, a struggling market

With the global pandemic that emerged in 2020, movie theaters remained closed or were restricted for several months, which put a strain on the film distribution industry. Movie theaters saw their admissions drop by 70% in just one year.

Distributors lost between 50% and 80% of their turnover, which then reduced their ability to finance and invest in films. The number of films produced has dropped, due to a lack of financing. In an attempt to combat this decline, in 2020 distributors received a bonus from the public authorities, encouraging them to continue investing. This subsidy, which was initially effective, has seen its effectiveness diminish over time, as cinemas have remained closed.

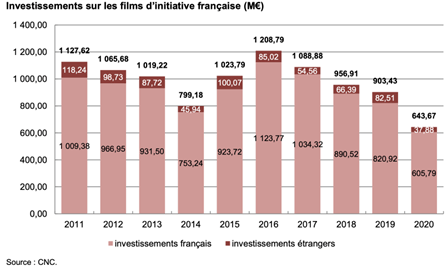

Indeed, as shown by the study conducted by the CNC in 2020 there is a drop of 28.8% of total investment in French films The films with French initiatives produced abroad are also reduced because the international productions become difficult with the crisis, so the investments they receive fall by 54.1%.

Competition in the film distribution market

Participants in the film distribution market

The film distribution market is made up of many players, of various sizes. There are the major distributors, the “majors“, who are also the best known : Warner Bros, Walt Disney Studios, Twentieth Century Fox, Sony Pictures… and who produce many successful films. There are also distribution companies linked to cinema networks, such as UGC or Pathé, and those linked to television channels, such as TF1 distribution or Studiocanal. Finally, there are a large number of independent distributors, the best known of which are Pyramide, Wild Bunch, and Carlotta films.

In this market, distributors are also divided according to the types of movies they distribute, as some are specialized in the promotion of artistic films, or foreign films, for example.

These distributors are spread across France, but are mainly located in the Île-de-France region, and it is also in this region that the distributors receive the most cash.

In 2022, Universal is at the top of the list with 14 million admissions, just ahead of Walt Disney Studios with 13 million admissions. Then we find Warner Bros and Sony Pictures, which respectively account for 10 million admissions and 9 million admissions this year. This is the first time since 2015 that Universal Pictures has topped the rankings, thanks in part to James Bond : Dying Can Wait. The rankings change from year to year, but it’s usually the same distribution companies that remain in the top 5.

Compétition deemed « distorted »

For years, certain companies have dominated this market, due to their larger size. Already in the early 2000s, there was a concentration of certain companies that earned the largest profits : the 30 largest companies received more than 98% of the receipts.

The film distribution market is in an oligopolistic situation, which means that competition is dominated by the big companies. The latter are accused of distorting this competition, as they hold almost all the market shares, undermining small and medium-sized distribution companies or discouraging independents.

Indeed, these companies have subsidiaries that allow them to both produce and distribute a film, which gives them a great advantage. They also offer loyalty cards to their customers, which destabilizes the market.

Sources